The accomplice is a willing participant in a money laundering operation. This persona voluntarily executes multiple transfers from their existing accounts. Mule Account Detection addresses this use case by detecting new, suspicious behavior from existing accounts, as well as altered transaction amounts and velocity.

Preventing criminal growth

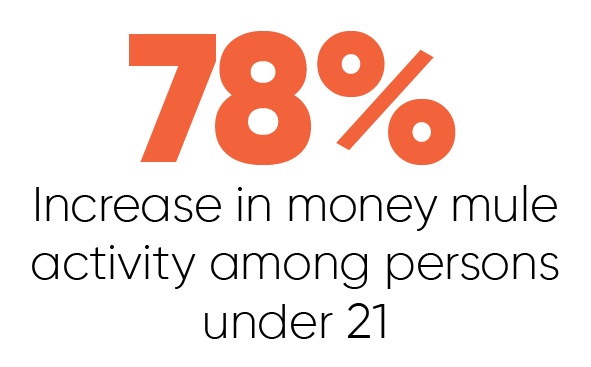

The recruiting tactics used by criminals to grow a money laundering operation are simple yet very effective. They offer easy money opportunities to attract these accomplices. These converted accounts have the same user, devices, and history, which allows them to go undetected with standard investigation methods and fraud prevention technology. BioCatch’s models observe data familiarity, behavioral anomalies, and activity trend changes to detect the subtle behavioral changes in the accomplice. This Behavioral Biometric intelligence from Mule Account Detection detects these high-risk accounts to proactively prevent them from transacting laundered funds.

By detecting this persona, banks and financial institutions can prevent genuine customers from using their accounts for illegal purposes. Click here to learn more about this persona and how Mule Account Detection can stop willing accomplices in their tracks.

use cases (FRAML)

The account peddler

The misled mule

Identity Theft

%20(1).png)