Cutting-edge AML technology is a must-have for banks and financial institutions to proactively prevent and

mitigate money laundering activity. The traditional investigative approach is simply not enough. Mule Account Detection with

Scout link analysis can uncover hidden money laundering networks and connect the dots between fraud and AML.

Problem overview

In the world of financial and cybercrime, most scams, theft, and fraudulent behavior either involve a financial account or end up in one. This remains true for many illegal businesses that include drugs, trafficking, and more. All roads lead to money laundering via financial accounts.

The problem is that while there is clearly an overlap between fraud, scams, and money laundering, many banks and financial institutions tackle these issues independently. This includes using traditional one-off solutions while working in siloed teams. While this may have worked in the past, there are many holes in this approach. The technologies tend to be reactive instead of proactive, resulting in many operational inefficiencies. According to a recent Forrester study, 78% of financial institutions said they struggle to respond to fraud activity early; nearly 70% stated the same for money laundering. This can lead to many false positives and increased investigation times.

Learn how Mule Account Detection provides the added layer of behavioral intelligence to bridge the gap between EFM and AML.

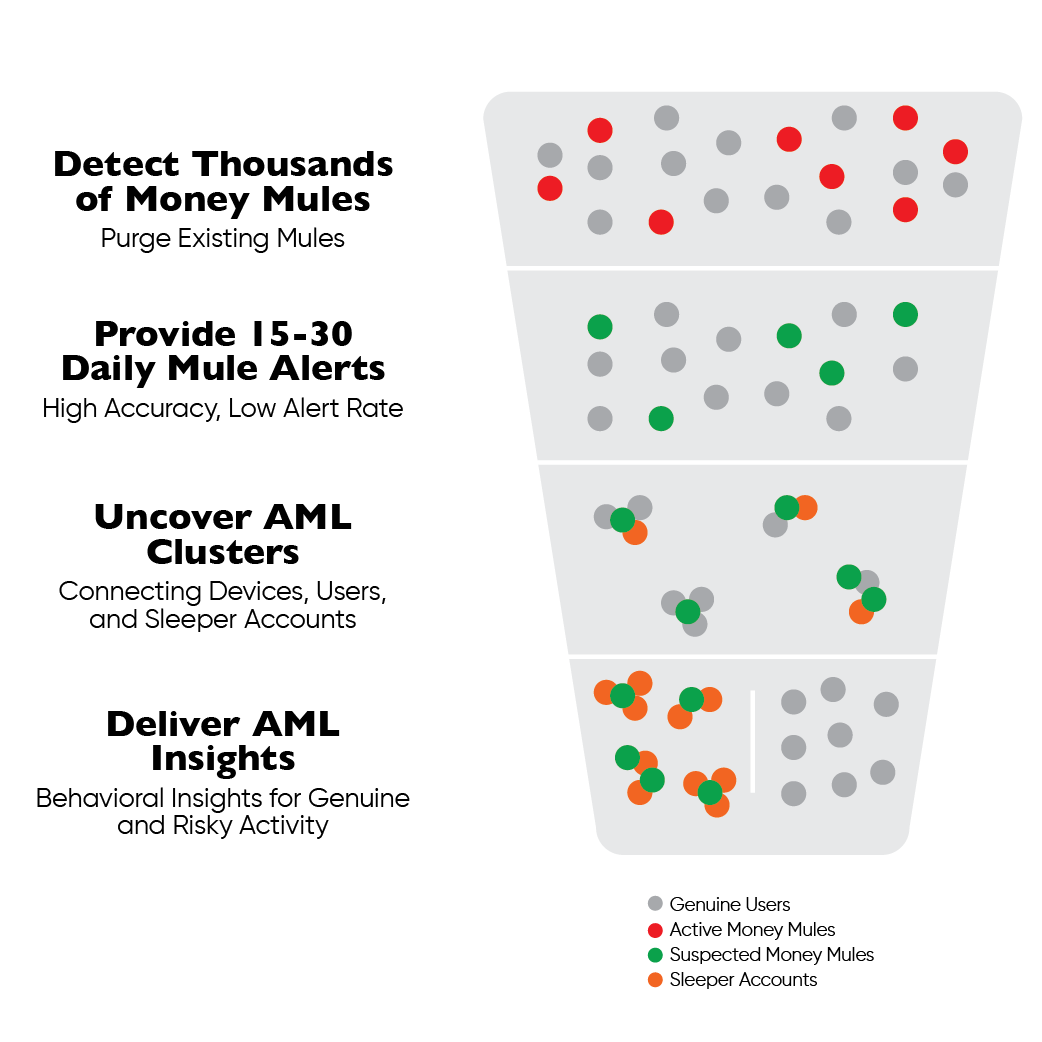

How BioCatch AML technology works

Money laundering rings operate like modern-day pyramid schemes. The worst of the worst are at the top, followed by the middle management recruitment layer. The base of the entire operation is held up by account harvesters and worker mules. To disrupt this operation, BioCatch’s AML technology, Mule Account Detection with Scout link analysis, proactively detects suspected and existing mule accounts. After they are detected, the solution provides highly accurate daily alerts. Once the alerts are provided, BioCatch Scout then analyzes the data and graphically displays the connected clusters and insights to prioritize investigations.

Improve fraud and AML operations with a proactive and unified approach

Did you know that 69% of financial institutions reported the number of days they spent on AML investigations increased last year? Or that three out of five financial institutions still struggle with early detection of fraud events? These are just some of the surprising findings shared by more than 150 fraud and AML decision makers at financial institutions across North America, Europe, and Latin America and published in a new report by Forrester Research.

use cases (FRAML)

The account peddler

The accomplice

The misled mule

%20(1).png)