HOW WE DO IT

Advanced fraud protection without compromising user experience.

BioCatch’s AI-driven platform transforms digital behavior into powerful insights to deliver advanced fraud protection without compromising user experience.

From Behavior to Action

Collect

Collect thousands of interactions per session

Analyze

Analyze digital behaviors against global historical profiles

See

See behavioral data transformed into powerful insights

Act

Act in real time to mitigate risk and improve customer experience

The BioCatch Platform empowers organizations to:

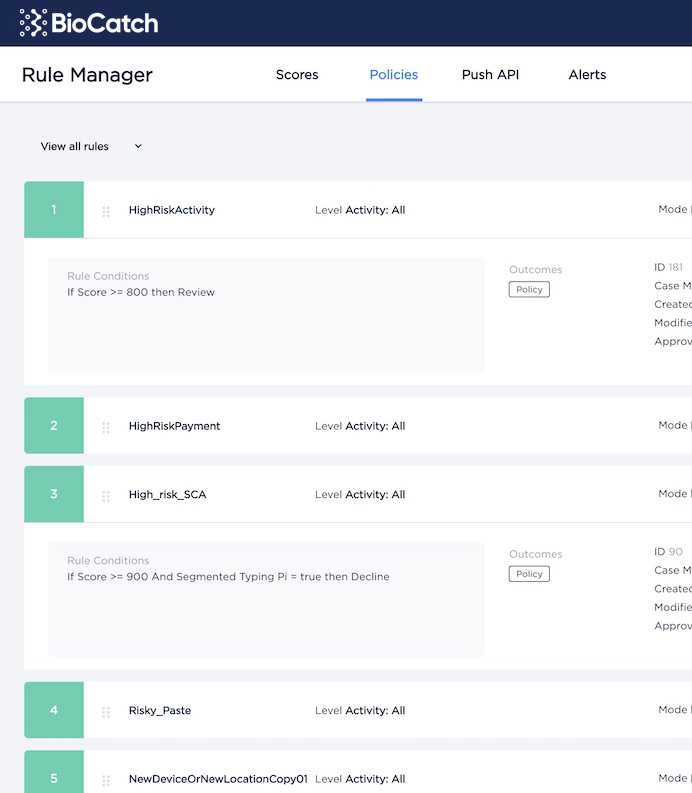

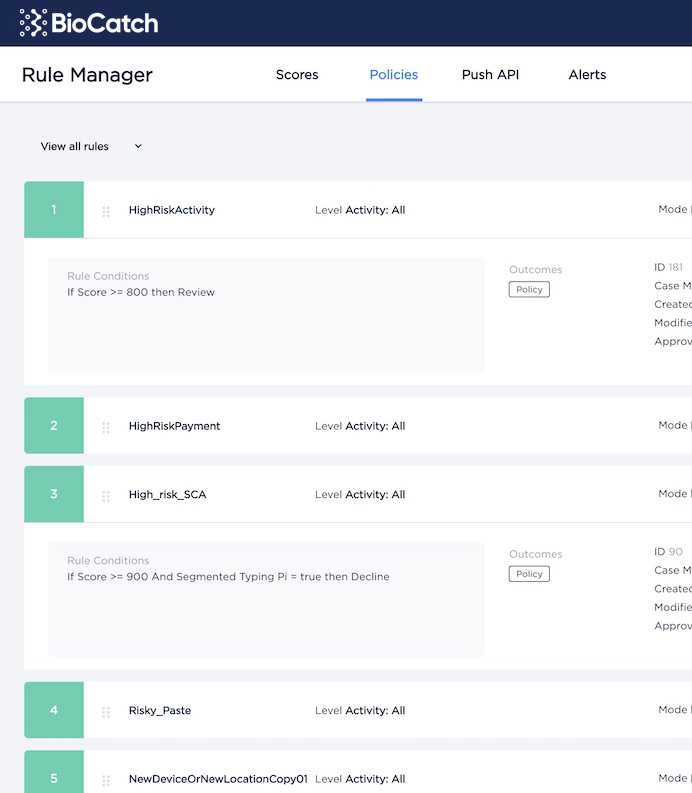

Drive Real-Time Action

Specify actions based on risk level and unique behavioral insights to reduce fraud and banish friction.

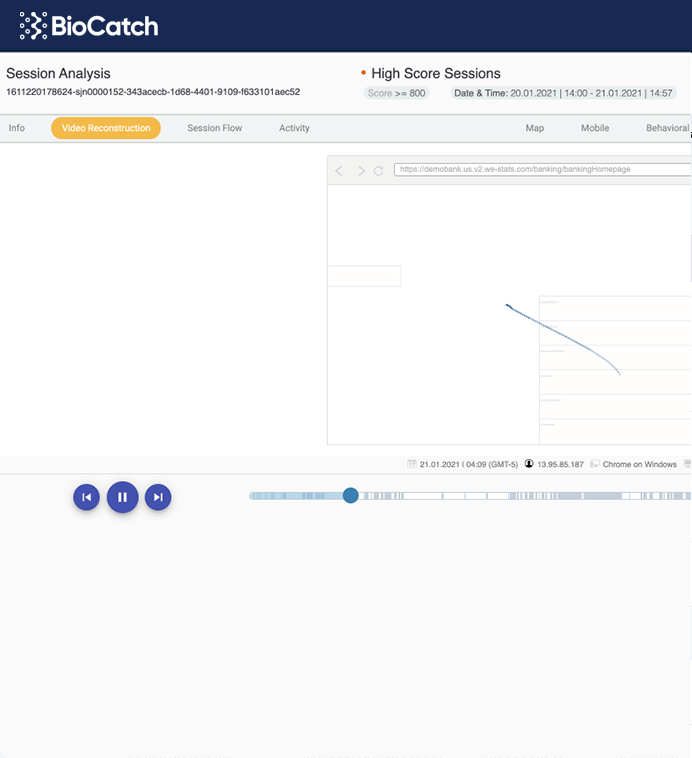

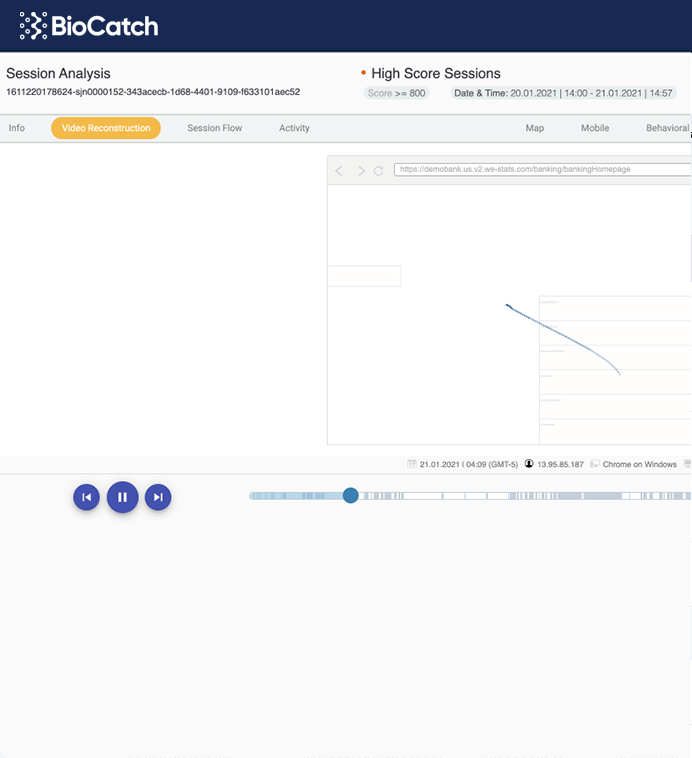

Gain Profound Visibility into Risk

Conduct in-depth investigations and reveal fraud trends with a powerful set of visualization tools.

Drive Real-Time Action

Specify actions based on risk level and unique behavioral insights to reduce fraud and banish friction.

Gain Profound Visibility into Risk

Conduct in-depth investigations and reveal fraud trends with a powerful set of visualization tools.

Drive Real-Time Action

Specify actions based on risk level and unique behavioral insights to reduce fraud and banish friction.

Gain Profound Visibility into Risk

Conduct in-depth investigations and reveal fraud trends with a powerful set of visualization tools.