When discussing fraud prevention in digital channels, it is often assumed that the Head of Fraud Prevention is responsible for safeguarding these channels and should take the lead in this area. However, it is crucial to shift the focus towards the business leaders and channel owners who ultimately bear responsibility for the success of digital channels.

One of the primary reasons for the popularity of digital channels is their ability to provide customers with enhanced banking experiences and cost benefits for banks. For customers, digital channels offer the convenience of conducting their banking in seconds from any device, without the need to drive to a branch, wait in line, or adhere to business hours. For banks, digital channels dramatically reduce the cost to serve customers, with the cost per transaction often 8–10 times lower than that of physical branches.

Therefore, if both customers and banks derive substantial benefits from digital channels, why should customers visit branches?

While digital banking offers a wide range of services—such as checking balances, transferring funds within set limits, requesting card replacements, changing PINs, and updating transaction limits for card-present and card-not-present transactions—certain services remain branch-only for good reason.

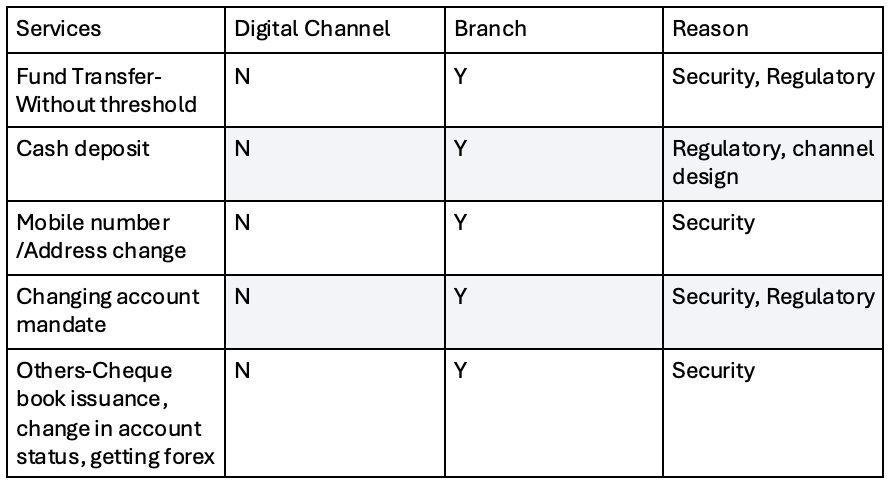

These limitations are often due to security considerations or regulatory requirements. Services that typically require a branch visit include high-value fund transfers exceeding digital thresholds, cash transactions, cheque deposits, accessing safety deposit lockers, and updating sensitive personal information like address, mobile number, or email.

To illustrate the common services not offered through digital channels, I have created a table below. It is important to note that the offerings through digital channels may vary across different banks and regions.

Can the service offerings through digital channels be enhanced? The answer is yes, with a condition that the bank must know that it is the customer performing the transaction and not a third party using the customer’s identity, or that the customer is not a victim of a scam whereby, unknowingly, a customer transfers their life savings to fraudsters. If channels are secured and customer authentication is robust, regulators may not challenge enhanced offerings through digital channels, as they are primarily concerned with ensuring that banking channels are not used for illegal activities and that banks are aware of their customers and their profiles.

By employing robust fraud prevention and monitoring systems, service offerings through digital channels can be enhanced to ensure higher utilisation of digital channels, lower visits to branches, and improved margins for banks. Rather than viewing fraud prevention as a cost, it could be a tool to enhance profitability of channels by attracting customers to engage more through digital channels. It can serve as a customer retention strategy as well as a unique selling proposition to attract new customers.

What could be preventing banks from implementing this strategy, if it is so evident?

One distinct reason that I can discern is that stakeholders must be closely aligned. The objective is to make banking profitable while simultaneously securing digital channels. This can be achieved by calculating all the benefits that a secured digital channel can provide – reduction in cost per transaction, increase in customer retention, increase in assets under management (AUM), increase in new-to-bank customers, and utilisation of new service offerings through digital channels to name a few, and of course, reduction in fraud losses to customers and banks.

We will delve deeper into this topic in the subsequent blog post.