Scams are a pervasive threat across the globe, and much emphasis has been put into discovering what the true cost of them are. The UK is at the forefront of measuring and reporting on the financial losses associated with scam activity and estimates between £1.3 to 2.35 billion lost from consumer fraud.

While measuring financial losses from scams is often difficult, or perhaps even inconsistent, due to the lack of common classification frameworks, it would be dishonest to overlook that a majority of scams are unreported or underreported. According to the UK’s National Crime Agency, nearly 90% of fraud and scams are underreported by consumers. Whether out of embarrassment or shame of being a victim or simply because consumers don’t know how or where to report an incident, the number is startling.

The Victims: Scammers Do Not Discriminate

Headlines shout figures about financial losses, but they disguise the real human cost of the fraud. Action Fraud reports they receive 300 calls a year when someone is at risk of suicide. This matches with the growing reports across the globe of fraud victims struggling with mental health issues – or even taking their own life – after being scammed. The emotions driving them to this are varied, from the shame of sextortion, the emotional betrayal of a romance scam or just people no longer having anything to live for after being made destitute. I think it can be rightly argued that this is the real human cost of fraud.

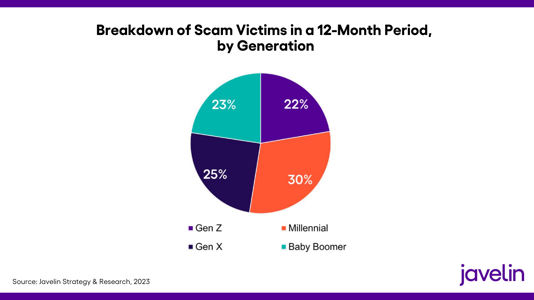

A surprising revelation is who the victims are. There is a misconception that a majority of victims are elderly, but scammers do not discriminate. A recent study by Javelin Strategy & Research found that scam victims are equally represented across all age groups as shown in the figure below.

Despite the prevalence of financial crimes, one of the reasons why law enforcement is perhaps so ill-equipped to deal with fraud is the perception that it does not constitute a direct threat to life. Policing globally rightly prioritises the threat of harm to the person as their main driver rather than financial loss, but do we now need to take a wider look at what prevention of harm now constitutes?

New regulatory proposals, such as the UK’s Payment Systems Regulator (PSR) and more recent EU Payment Services Directive III (PSD3), requiring mandatory reimbursement for fraud scams should help alleviate some of the human cost and is to be welcomed. Public/private sector partnerships and improved scam detection need to consider the human cost – not just the financial one. This does not only extend to the banks but also social media sites, telcos, and others in the wider scam chain.

When Scammers Become Victims Too

Now that we have a better idea of who the victims are, let’s take a look at the scammers. When talking about the people who perpetrate scams and socially engineer the victims, they are often demonised as not just being criminals but the worst kind of humanity. Descriptions such as vile, heartless, immoral, cruel, nasty, and greedy are just some of the terms you might hear to describe a scammer. But is this really the case?

When we consider the start of the scam chain, there is another group who has been overlooked until more recently – the people who are making the calls or sending the messages which ensnare the victims who are defrauded.

Both law enforcement and independent investigators have tracked many of the scam operators to call centres, mostly within Asia. Some of them seem to be run with employees who willingly work and acknowledge what they do is illegal and can rise up in the ranks with promotions depending on how much money they bring in for the ring leaders who fund these multi-million dollar enterprises. Many of these call centres operate in India, run as quasi-legal companies, and offer better pay compared to legitimate outsourced call centre work.

However, there is a dark underbelly of scam operations that has emerged in recent years with these scam call centres now being replaced by more insidious enterprises where the people making the calls and sending messages to potential victims are themselves victims of human trafficking. These victims, ensnared through fake job adverts offering travel and accommodation, find themselves at the mercy of gang leaders. They are saddled by debt bondage with punitive interest rates, trapped within fenced compounds, and working in modern slavery conditions. If they do not perform, they suffer physical abuse and even worse forms of exploitation.

Across Southeast Asia, it is estimated that tens of thousands of people have been dragged into operating these scams. The issue has become so large that Interpol issued an Orange Notice in June 2023 showing that scam call centres have been concentrated in Cambodia, Laos, Myanmar, and at least four other countries. They noted the operators are now recruiting wider with people being trafficked from further afield (South America, East Africa and Europe) bringing new languages and cultural awareness to broaden the scope of attacks. They have moved from Chinese victims to now focus on North America, Europe, and the rest of Asia. As a result, there has been a 200% increase in call scams this year.

There has also been a move from recruiting just call centre staff to increasing the technical capability of the attackers. IT professionals and digital marketing skills are in demand to create the websites and fake ads that lure the fraud victims.

Law enforcement efforts to shut down these call centres across the region has achieved some success, but the amount of money involved means they often reappear. Thailand and the Philippines have rescued human trafficking victims in some notable high-profile operations, but the centre operators remain at large.

Interpol has reported evidence of dedicated scam call centre hubs being replicated in West Africa and Central and South America, facilitating industrialisation of attacks from there. Criminal syndicates, such as Black Axe in Africa and Drug Cartels in Central and South American, are expanding, and corrupt officials allow it to happen. These crime groups now see financial crime equally as profitable as drug trafficking and at a lower risk of being caught or prosecuted.

The Hidden Human Cost of Fraud

The reality is that digital fraud and scams is dominated by organised criminal groups where regard for human life is often absent. There are victims at both ends of the scam chain who are losing their lives - those harmed by the impact of the crime and those trying to escape from the criminals who imprison them. In Mexico, eight young workers were found butchered when they tried to quit a cartel call centre targeting the USA with scams.

Organised criminal groups are already utilising AI such as ChatGPT to enhance their capabilities with language translation and automated conversational chat. Although Generative AI raises a new set of issues for scam detection, in some ways, it is preferable to be facing AI attackers because there is no victim who could face physical harm as a result of not succeeding in the fraud.