The global rise in authorized payment scams has put renewed attention on money laundering and the role of mule accounts as part of the fraud ecosystem. Central to this shift has been the ongoing debate about liability for reimbursing scam victims and who bears financial responsibility. The UK Payment Systems Regulator was the first to put forward policies to require reimbursement for authorized payment scams, and perhaps more significantly, the first to require receiving banks to bear 50/50 responsibility. The Reserve Bank of India also recently updated their Master Direction on Know Your Customer with new amendments focused on improving controls to detect mule accounts. Regulators and lawmakers in other countries, including Brazil and Australia, are also expected to issue guidance to a similar tune.

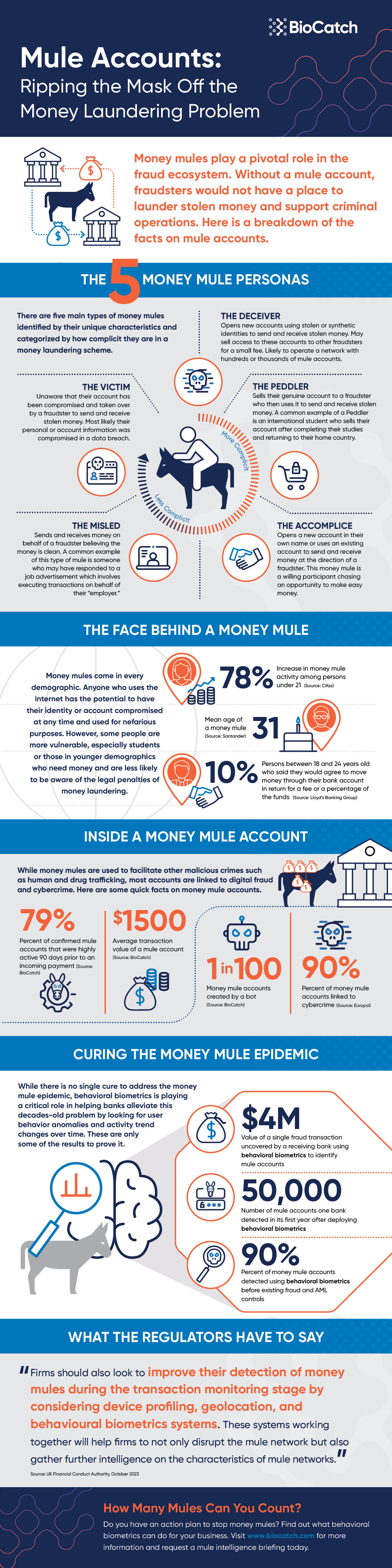

The world of money laundering and mule accounts is a tangled web of complex criminal operations. Fraud fighters must understand the intricacies of this vast underground world as every fraudulent payment they work to stop must flow through these networks. Let’s take a look behind the mask of the money laundering problem.