BioCatch Connect Event in London

Standing on the 42nd floor of the Leadenhall Building in London, admiring the views and waiting for our customers to arrive, I was excited about the day ahead. The events team pulled together a jam-packed agenda, and set up eight tables with 80 seats for all the passionate fraud fighters arriving at 9am. First up on the agenda was registration and breakfast. This was a great opportunity to catch up with customers and discuss the day ahead. In attendance were fraud fighters from HSBC, NatWest, Barclays and TSB. They had all travelled from far and wide, and seemed happy to escape their home offices for the day.

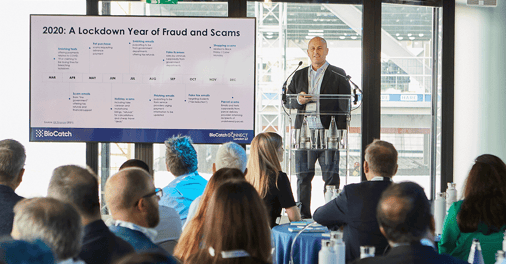

Our CEO, Gadi Mazor, travelled in from Israel to formally kick-off proceedings at 10am. He spoke passionately about the importance of collaboration, and how coming together as a fraud-fighting team gave us the best chance of beating fraud. After Gadi, several members of our Threat Analyst team took to the stage and talked through some great insights about the current EMEA threat landscape. They also elaborated on some important fraud trends to watch out for in the coming year.

Our CEO, Gadi Mazor, travelled in from Israel to formally kick-off proceedings at 10am. He spoke passionately about the importance of collaboration, and how coming together as a fraud-fighting team gave us the best chance of beating fraud. After Gadi, several members of our Threat Analyst team took to the stage and talked through some great insights about the current EMEA threat landscape. They also elaborated on some important fraud trends to watch out for in the coming year.

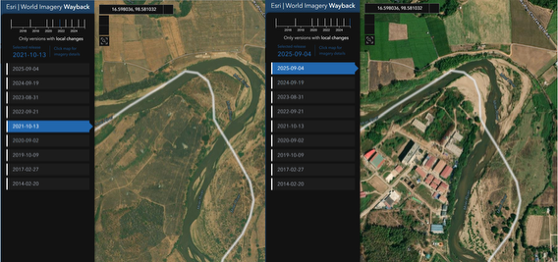

After going through the six trends including social engineering, the role of social media in fraud, and the increasing global mule account problem, Iain Swaine from our Global Advisory team conducted a 20-minute presentation on what banks should expect for the next year. Sometimes it is easy to lose sight of the bigger picture when tackling fraud. But Iain did a great job of walking the audience through economic factors and risks, the importance of kill-chains and the geopolitical factors that could influence some shifts in the fraud landscape next year.

|

|

After Iain finished, it was time to let someone outside of BioCatch take the stage. Just before we stopped for lunch, Lee D’Arcy from CIFAS took us through another perspective on the fraud landscape. Lee’s presentation reiterated some of the concerns we share at BioCatch, and stressed how important collaboration is, and why we should be working together to build a national fraud framework.

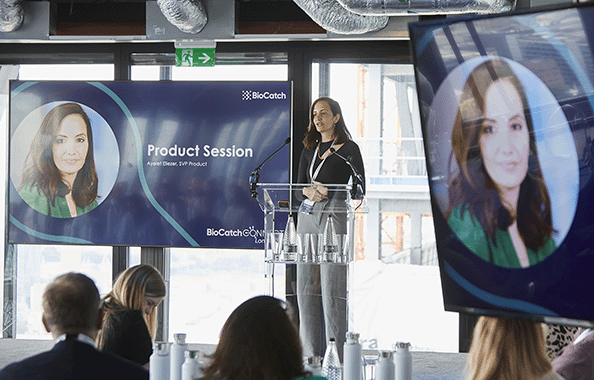

After lunch, Ayelet Eliezer, SVP of Product, led the Product session. To kick-off Ayelet recapped what was discussed with customers last time round, and how we have progressed since then. She then moved on to our four focus areas moving forward highlighting what they will mean from a product development perspective. To round off the interactive session, Ayelet shared some detail on some imminent feature releases and what these developments would mean for customers.

Concluding the Product session meant we were at the halfway stage for the day. Next up on the stage was a couple more external guests. Firstly, Geoff White, the award-winning TV journalist at Channel 4, gave a brilliant, light-hearted account of some epic cases of fraud. He elaborated on how the main offenders got away with their crimes for so long, and talked about some of the rock-and-roll lifestyles they led. It helped us all understand why a lot of young impressionable people get lured into a life of cybercrime.

Next, Patrice Amann, a Senior Director from Microsoft, emphasised the importance for banks to continue to improve their cyber, fraud and KYC-AML defences. Patrice painted a brilliant picture of how Microsoft intends to expand their cloud infrastructure to make sure it’s ready for the astronomical growth ahead.

|

|

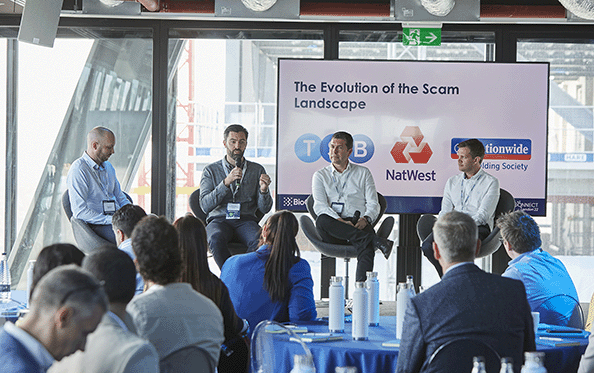

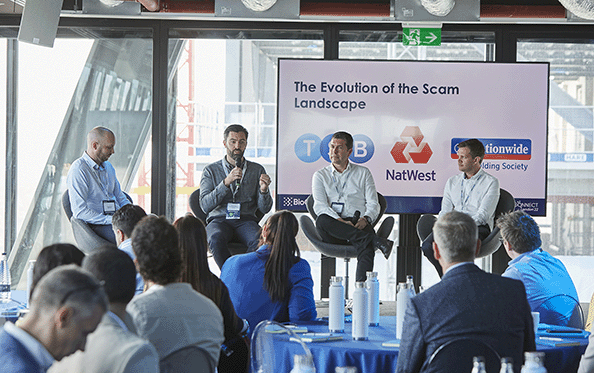

After another short networking break, it was time for a panel discussion. Customers from NatWest, Nationwide and TSB sat on stage to discuss one of the most important trends: the evolution of social engineering scams. Grieg Burns (Threat Analytics Consultant) asked some thought-provoking questions and the panel responded with some compelling insights and learnings around authorised push payment scams. This was exactly the collaborative flavour we hoped for with BioCatch Connect. It captured the essence of what we were trying to do, which was to come together to beat fraud.

The final session of the day was a customer award ceremony. Among others, there was awards for Digital Innovation and Best Collaboration. It was important to us that our customers felt highly appreciated. They contribute to the success of BioCatch more than they know. And we value the role they play in making our business a success. They help us think. They help us grow. And they help us stay relevant when it comes to building solutions that help them and neighbouring banks achieve their business goals.

I wondered what our customers would make of the day we arranged in the Leadenhall Building. When I asked some of our customers, “What are your key takeaways from today?” Nearly all of them said how they recognise the importance of coming together to talk. Brad Pitt famously quoted in a movie once, that the first and second rule of Fight Club is to not talk about Fight Club. But this mentality couldn’t be further from the rules of our Fraud Club. Coming together and talking about fraud prevention is key, and that’s why we’re not going to stop at one event in London. We will be doing follow-up BioCatch Connect events in North America, Latin America, and the Asia Pacific region soon. Reach out to your BioCatch connection if you would like to learn more.