Fueled in large part by the global pandemic, the concept of digital transformation matured almost overnight from a marketing slogan to an accelerated business practice. Microsoft summarized it most aptly, stating we saw “two years of digital transformation in two months.” Whether looking to stand up a remote workforce or service customers in online channels, organizations worked diligently, and in most cases successfully, to thrust us into a new age of the digital norm.

One industry that has felt the benefits of the digital age most profoundly is financial services. Some banks reported upwards of a 200 – 250% increase in mobile banking registrations, and adoption of new financial products is changing the way consumers bank and manage their money. The use of P2P payment apps, such as Venmo, Zelle and CashApp, increased 83% last year, and three out of four consumers used a Buy Now, Pay Later (BNPL) service for the first time during the pandemic. Even the landscape of the digital banking population has changed with more seniors and underbanked populations now doing business online.

Despite the great advancements made during the course of the pandemic, every success always comes with a dark side. With consumers plugged in more than ever to their personal devices, this has created a gold mine of opportunity for cybercriminals. While there has not necessarily been much new in the way fraudulent schemes are executed, there has just been more of them and more potential targets – all at a dramatically increased pace.

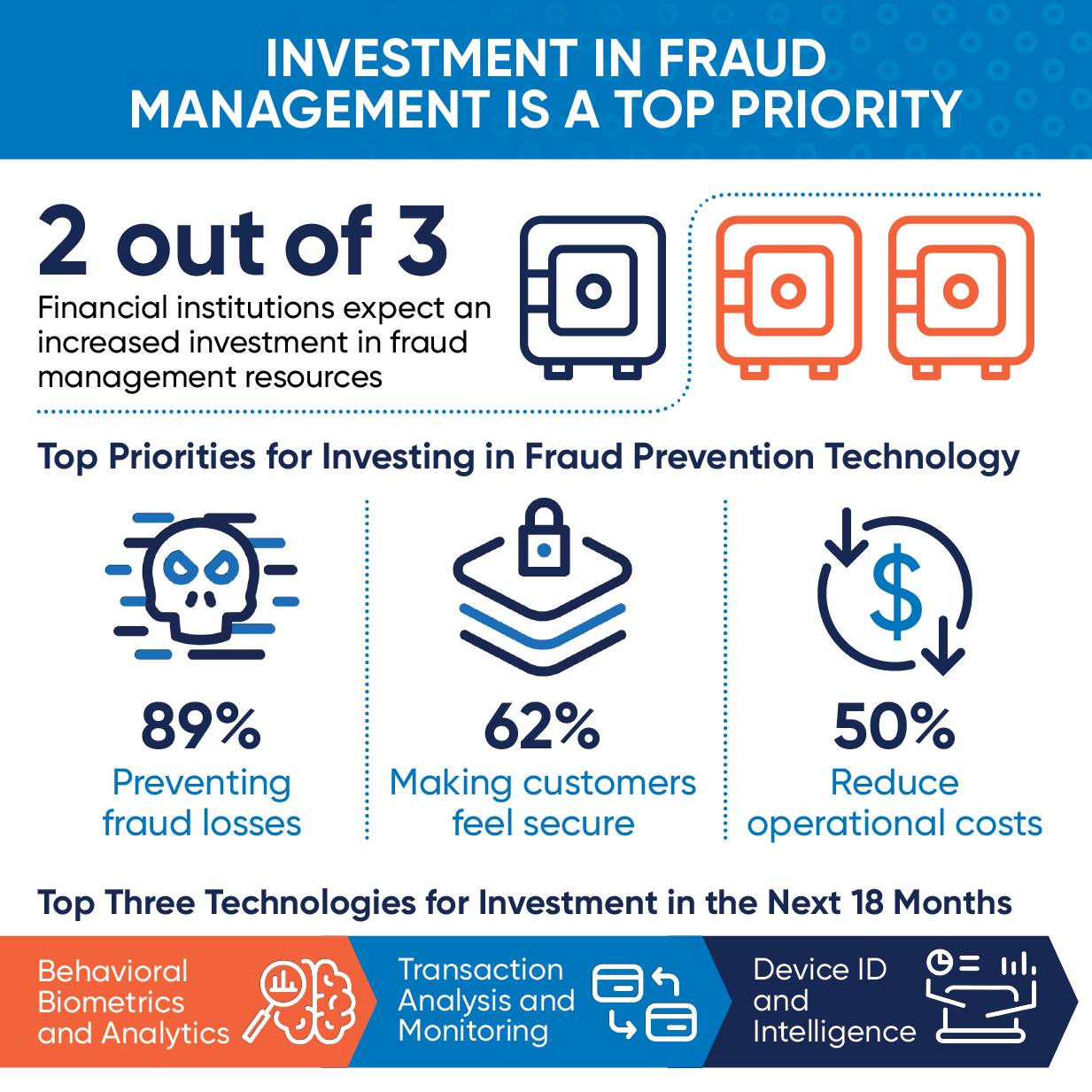

To understand the effect of these changes, BioCatch, in partnership with Information Security Media Group, conducted a survey of fraud and cybersecurity executives at more than 175 global financial institutions. The survey sought to gauge their insights on the fraud schemes that have caused the most concern and financial impact over the last year, the top business challenges to preventing digital fraud, and priorities for anti-fraud investment in the coming year.

You can download a copy of the report and full analysis of results here. A summary of the key findings is also included in the infographic below.

.jpg?width=788&name=Infographic-Transforming-Fraud-Management%20(1).jpg)