Well overdue national attention towards addressing the exploding problem of financial scams on U.S. consumers has finally gotten a starting point. On June 10, 2025, U.S. Senator Mike Crapo (R-Idaho) and U.S. Senator Mark Warner (D-Virginia) introduced the bipartisan Task Force for Recognizing and Averting Payments Scams (TRAPS) Act. They are joined in sponsorship by U.S. Senators Jerry Moran (R-Kansas) and Raphael Warnock (D-Georgia). The TRAPS act would create a task force to combat the growing issue of payment scams.

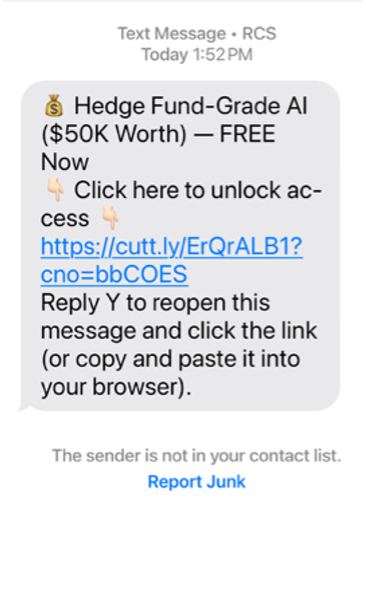

Readers of this blog post likely do not need a recitation of statistics outlining the depth of the financial scams problem in the U.S. Over 60% of U.S. consumers have experienced a scam in their lifetime. If you include anyone who received a text message like the one shown here, it is likely that number rises to everyone with a cell phone! And these numbers are significantly under-reported, as 57% of people who indicate they have been a victim of a scam do not report the event to the relevant.

With far less risk than walking into a bank brank with a gun and saying “stick ‘em up!”, fraudsters have figured out they can cajole people into sending them money. The quality of scam content has improved with the help of AI, and these crimes are not being perpetrated by individuals. Scamming U.S. consumers is big business in other parts of the world, with entire office complexes dedicated to the craft.

The first step toward a whole-of-industry scam strategy

A task force is not the answer – but it is a beginning. The problem of scams has been framed as a failing of the payments system. Nothing could be farther from the truth. Scams are a whole of industry problem – the payment is the last step in the process, and by then the consumer – in the case of a scam – is giving a proper instruction to their FI to send the money.

The discussion of scams tends to focus on the instant payment schemes, but all payments require risk management against this scourge as highlighted by the ACH network taking steps to address risk management on the receive side of payments. As Cam Fowler, CEO of Early Warning Services noted in Sen. Crapo’s press release, “Scams don’t originate on payment platforms.”

My opinion has yet to be solicited, but if it was, what would I have the task force “do”?

- Recognize the “whole of industry” nature of the problem

Importantly, under the proposed legislation, the task force would include representatives from the U.S. Department of the Treasury (as chair), the Consumer Financial Protection Bureau, the Federal Communications Commission, Federal Trade Commission, U.S. Department of Justice and representatives from industry. The addition of the Department of Homeland Security (both because financial scams are a threat to homeland security and because this includes the U.S. Secret Service) and perhaps some organizations such as National Sheriffs' Association (NSA), International Association of Chiefs of Police (IACP) and National Fusion Center Association (NFCA) would complete law enforcement participation. This recognizes the broad economic nature of the problem.

As for “industry participation,” it is critical that social media platforms are at the table and willing to participate productively to address the problem. One UK bank reports that 80% of scams originate on social media. Chase has taken to asking the nature of a payment and taking a pause when the payment is identified as originating on social media. The problem must be addressed at its origination. - Create clear definitions

The word “scam” is far too broad. Statistics often conflate scams with other types of fraud. As a result, reporting on fraud loss statistics is widely varied and lacks the granularity to initiate programs to stop particular types of scams. Quality reporting, like that from the FTC Consumer Sentinal Book, lumps all types of fraud together – including things like identity theft, medical scams and credit card fraud. A clear definition of “scam” as a subset of fraud is necessary to productively track and manage our progress fighting this scourge.

The Federal Reserve Fed Payments Improvement initiative convened the payments services industry (financial institutions, payment service providers, fraud providers, consumer advocates, etc.) to start the discussion on ways to address financial scams. One of the artifacts of that effort is the ScamClassifier model. This would be a great place to start to create more granular tracking of progress. - Enable information sharing

In a scam scenario, the fraudster lives on the receive side of a transaction. In push payment scenarios, the party creating the payment has good information on their customer, but limited information on the receiver. Creating ways for financial institutions and payment service providers to share information about receive side accounts will be critical to solving this problem. This can be done in privacy preserving ways that do not interrupt or compromise the 99%+ of transactions that are bona fide. - Empower law enforcement

Fraudsters seem to think they can run their scam operations with impunity. Stealing money from consumers and businesses with little risk of being arrested, prosecuted or incarcerated. There have been some legal wins on scam networks but far too few.

Laws need to make clear that this type of crime is illegal – and not just lumped into a category of “burglary” or “theft”. Sharing information between industry and law enforcement must be easier. Privacy protection is paramount, but the ability to identify networks of nefarious actors will require information.

Law enforcement WANTS to help. There are pockets of great success with coordination between law enforcement and the private sector. The task force needs to learn how these are successful and expand those models. - Destigmatize victims

Understanding the full extent of a problem is critical to coming up with solutions for the problem. Losses to scams could exceed $158 billion, if consideration is made for underreporting.

Those who fall victim to scams must be made comfortable coming forward to their family, friends, financial partners and law enforcement. Without fostering an openness of communication with the parties affected, the breadth of the problem will be masked, and the networks of fraudsters can hide major portions of their networks behind lack of information. - Shine a light on the fraudsters

Articles and reports abound about the victims to scams. More needs to be done to highlight the bad actors who are perpetrating these crimes. Efforts like Operation Shamrock bring the breadth of the problem to light. In doing so, they bring the attention of legislators, law enforcement, financial institution, payment service providers, and, perhaps most importantly, the consumer.

Final thoughts

What does creation of such a task force mean for fraud fighters today? In the long term, this is a good thing. Hopefully, the task force will enable public/private partnerships that not only help deter scam activity but also find and prosecute those responsible. While that is not always possible, creating disruption in the scammers’ networks can provide significant benefit.

Fraud fighters should pay attention to the work of the task force. If given the opportunity, participate. Provide input when the opportunity arises.

Today, evaluate your risk management stack. Look at everything from capabilities supported, the way “products” are packaged and presented to your consumer, and, of course, the technology you have to provide risk signaling. Do what you can to learn more about the receive side of a transaction. Create metrics that enable communication with your product peers and executives (the aforementioned ScamClassifier Model is a great start!).

We need to collectively stop running around the town square flailing our arms and decrying the problem and take specific actions to address scams. The TRAPS Act task force can shed a much needed light on the need for coordination from multiple stakeholders to protect American consumers. This is indeed a national emergency.