As digital business strategies become less about managing risk and more about embracing it, new technology will be critical to accelerating that transformation. Real-time P2P payments for mobile banking is a perfect example. As financial institutions expand their risk appetite to offer more functionality and new digital services to customers, there is always a hidden side to consider. Where is the middle ground between driving adoption and enrollment and increasing revenue while simultaneously protecting the P&L statement from fraud losses? This is a question on the minds of many fraud, security and risk management leaders today.

Digital behavior is shining a new light on identifying cybercriminal activity. Whether as a standalone solution or as part of a layered fraud management plan, behavioral biometrics is delivering extraordinary results and exposing the most advanced fraud attacks.

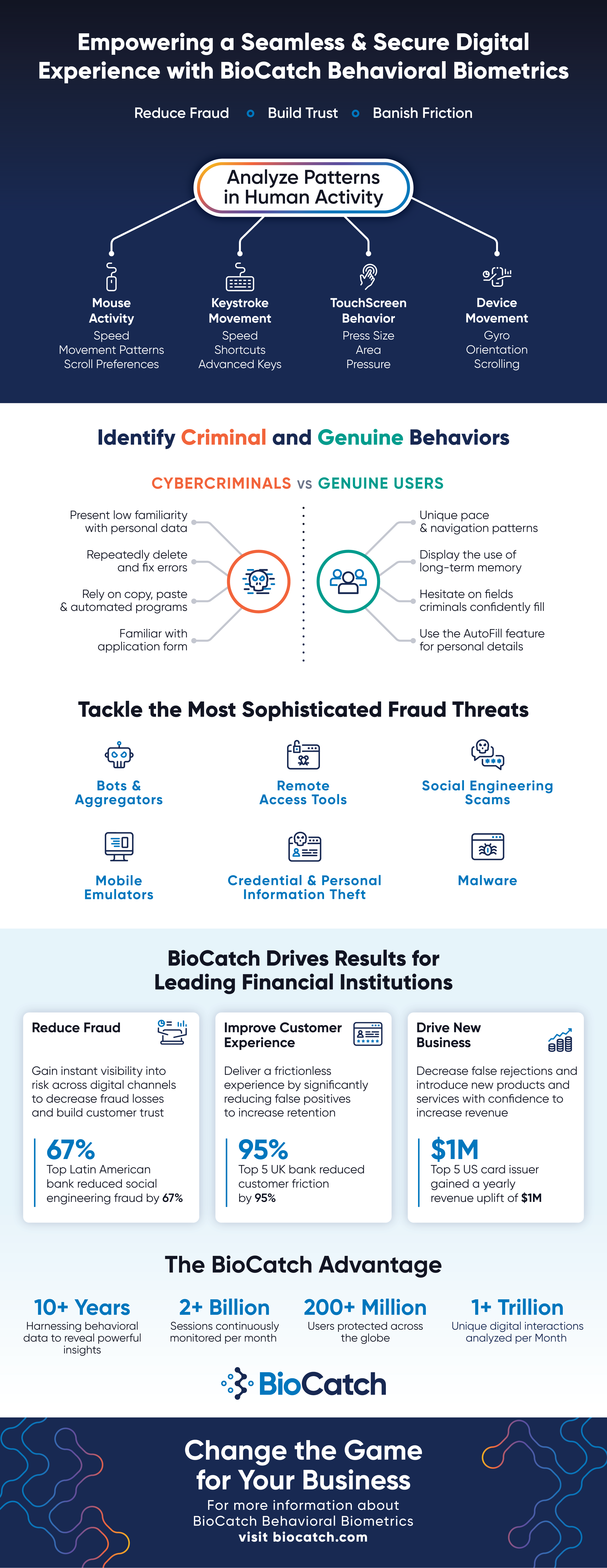

What is your top priority for building a trusted digital environment for your customers in 2021? See the positive impacts that behavioral biometrics has produced for financial institutions around the world in the infographic below.