Yes. Behavioral intelligence can detect financial crime.

But if we left it at that and ended it here, this wouldn’t be much of a blog post. Instead, you probably want to understand exactly how behavior can help.

Financial crime as defined by Interpol is any crime against property that involves the illegal conversion of assets for personal gain. From scams and fraud to corruption and money laundering, these crimes seek to obtain illegal profits by taking advantage of financial systems or tools. Financial crime seeks to accumulate wealth through illegal activities for a person, persons, or groups of persons.

According to NASDAQ’s 2024 Global Financial Crime Report, $3.1 trillion in illicit funds flowed through the legitimate financial system in 2023 alone. Fraud and scams accounted for $486 billion in losses that year – more than Chile’s entire 2024 GDP.

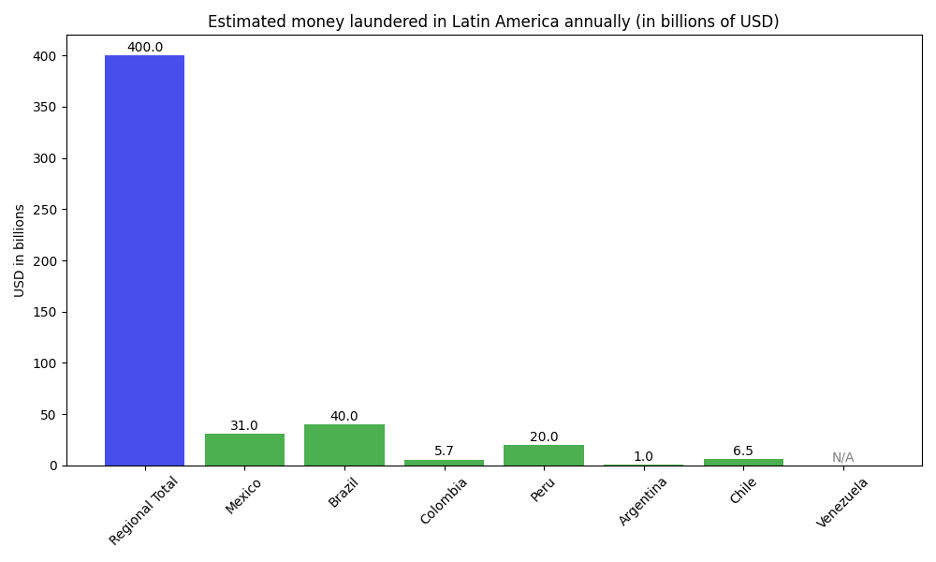

Estimates for Latin America suggest a similarly gigantic financial crime problem.

The above figures come from official reports and estimates by specialized agencies: Global Financial Integrity (for Mexico), national assessments (Argentina), statements by financial intelligence units (Colombia), and experts and specialized press (Peru, Brazil). All are very conservative. The true volume of dirty money in circulation in the region could be considerably greater.

Latin America faces enormous challenges in curbing financial crime. Some of the main obstacles identified include:

- Institutional and regulatory weaknesses

- Institutional and regulatory weaknesses

- Corruption and infiltration by organized crime

- Technological complexity and data volumes

- Informal economies and the use of cash

- Limited cooperation

Some of the emerging financial crime we see in the region involves cryptocurrencies and decentralized finance, shell company schemes, luxury assets and purchases, gambling, and online platforms for asset exchange.

Behavioral intelligence can help with prevention and detection in all these realms.

Machine learning models can analyze a customer’s transaction history and compare it to those of millions of others, detecting anomalies. These models excel at detecting subtle and complex patterns – for example, networks of accounts laundering money collectively through circular transactions.

Collaboration and data sharing can improve the performance of behavioral defenses further still. Looking at only its own accounts, no single institution can see the complete picture. Collaborative analysis between banks will be vital to combatting financial crime in Latin America and around the world. Already, initiatives in some jurisdictions allow banks to share certain transaction and customer data to identify mule account networks spanning multiple banks.

The result is better detection of typologies across the industry. These cooperative technology efforts are still in their early stages (BioCatch just launched the world’s first inter-bank, behavior-based, real-time intelligence-sharing networks in Australia and Argentina in November of 2024 and May of 2025, respectively), but they represent a promising advance in detecting complex laundering schemes that a single bank might miss.

We still have a long way to go.

True collaboration between competing financial institutions – first in the same country, then throughout the same region, and, finally, all around the world – is still in its infancy. The more banks that join networks like BioCatch Trust™ the better visibility we’ll gain into the criminal movement of money, allowing those banks deploying behavioral solutions to identify patterns in that flow of funds and recognize and stop financial crime in real time.

At Biocatch, we’re confident we can stop these crimes if we unite and collaborate as an industry. Join us.