Our 2025 Global Scams report examined data across 350 million accountholders at financial institutions on five continents and found global scam attempts rose by 65% in the last year. Some types are exploding: Romance scams are up 63%, investment scams 42%, and voice scams or vishing 100%. In APAC, scam volumes jumped 35% over the past year. Australia is the rare exception where losses are falling. But elsewhere — in India, Singapore, Indonesia, and the Philippines — scam losses continue to grow.

Heart first, wallets later

A person meets someone online and starts chatting. Over time, the conversations deepen. The two develop a bond. Then the talk turns to “an exclusive investment opportunity” or an offer to move in together. This is where the demands begin.

In Singapore, a 59-year-old man spent two years sending money to a woman he met on Facebook. He eventually sold his flat and transferred S$120,000 to help with her supposed “financial crisis.” It took ending up homeless for this man to finally realize he’d fallen victim to a romance/investment scam. By the time he filed a complaint with the police, it was too late.

Unfortunately, no part of this story is isolated or unique. We explored a very similar set of circumstances in our Business of betrayal story for the Dark Economy project. In June, Indonesian police arrested 38 suspects in Bali for running a love-scam ring targeting Americans. In September, an 80-year-old woman in Japan lost ¥1 million to a fraudster pretending to be an astronaut stranded in space needing oxygen. In Australia, a 26-year-old “Anne” started crypto trading at the urging of a scammer, losing her life’s savings and taking out loans to send her scammer more money.

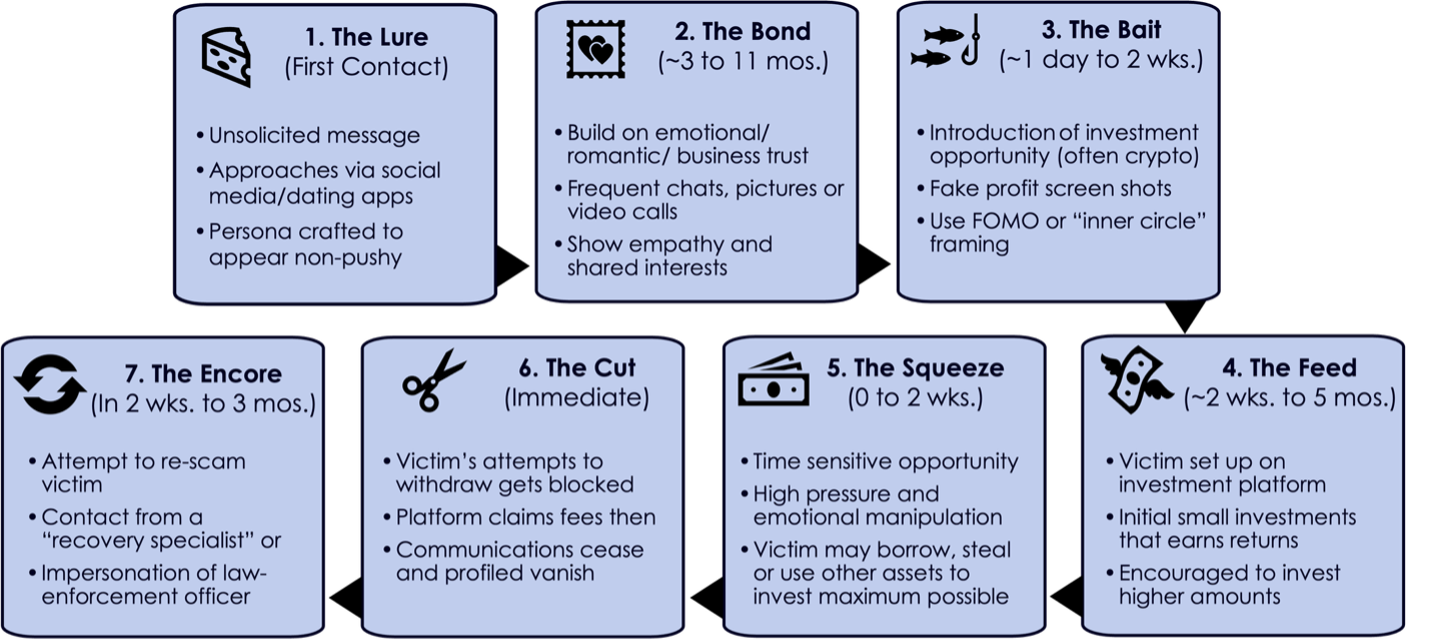

A striking orchestration of tactics is the crudely named pig-butchering scam (Sha Zhu Pan), which blends romance, fake investments, and staged profits. Victims are “fattened” with emotional bonding and small investment returns before the syndicate vanishes with everything. These operations often run out of Myanmar, Cambodia, and the Philippines, using fake trading apps, crypto rails and AI-generated identities.

An academic paper titled “Hello, is this Anna?: A First look at Pig-Butchering Scams” describes how scammers deliberately stage seven steps: initiate contact, bond, show fake profits, escalate investments, apply high pressure, ghost the victim, and recycle the profile for the next scammer. It’s assembly-line fraud.

Figure: The Seven stages of Sha Zhu Pan (based on the referenced academic paper)

The paper calls for cross-industry intervention: social-media platforms to detect unusual contact/relationship patterns, financial institutions to monitor suspicious investment-rails, and law enforcement to adopt non-stigmatizing terminology and improve cross-border cooperation.

The voice you trust is fraud

If romance scams weaponize love, impersonation scams harness fear. As per the BioCatch Global Scams report, Bank data shows a ~25% rise year-on-year in APAC.

In 2024, India saw nearly $235 million in digital arrest scams, where victims receive calls from fraudsters posing as police or tax officers claiming the victim is under investigation for money laundering or drug crimes. Some are shown fake warrants or staged video calls with bogus court officials. A former banker in Mumbai lost $2.7 million in just 30 days.

The Philippines has similar “warrant-of-arrest” scams that pressure victims to send money to what scammers describe as secure accounts. In Singapore, one man lost S$1.1 million after scammers impersonated the police, claiming his identity was linked to a crime and his money needed to be transferred for safekeeping.

Next-generation vishing is even darker. In June 2025, Thai authorities warned about scammers using AI-cloned voices of family members to demand urgent transfers. When the voice asking for help sounds exactly like your son or mother, any hesitation goes out the window. The pressure forces the potential victim to act. Impersonation is no longer just a convincing story — it sounds like someone you love.

The cart before the con

Purchase scams don’t have dramas of fake courtrooms or romances, but they are the most reported scam type in many APAC countries, making up 22%–35% of all cases.

On marketplaces like Facebook or Carousell (a popular platform in Southeast Asia), versions include:

- Goods that never arrive

- Fake concert tickets capitalizing on sold-out events

- Counterfeit items (the most prominent version of this scam type)

- Fake buyers sending phishing links disguised as bank portals to sellers

- Impersonated support agents who quickly move the chat off platform

What to watch out for: fake refund/return flows that ask you to “pay a release fee,” off-platform “private apps” often marketed as cost control measures, and account-takeover of reputable micro-sellers — all designed to bypass platform safeguards.

Singapore now publicly rates marketplaces on scam-safety levels. But until platforms enforce escrow-by-default, name-check features, and holds on first-time counterparties, purchase scams will continue to scale.

A rare bright spot

One country in the region is bending the curve downward. After peaking at A$3 billion in scam losses in 2022, that total fell by a third to A$2 billion in 2024 thanks in part to a coordinated ecosystem approach:

- Real-time scam-payment blocking

- Behavioral intelligence for detecting manipulation

- Real-time cross-institution intelligence sharing

- Mandatory bank payee name check

- Suspicious SMS and call blocking by telcos

What's happened and continues to take place in Australia serves as evidence that scam losses don’t need to grow every year indefinitely like inflation or tax rates. We can cut them back, but only when banks, telcos, regulators, and platforms move together instead of acting alone.

What must change

Public awareness helps, but it can’t stop emotional engineering. Victims who “know about scams” still fall for them when coached, groomed, or threatened. Password strength will not protect someone who has been psychologically manipulated.

Banks must look beyond strong authentication and use of both signature-based threat detection and device capabilities in this AI era. They need to detect customer intent. Continuous behavioral monitoring can spot signals of coercion, remote control, hesitation, scripted actions, or coaching — even when credentials look clean. Behavior is now the only way to catch a scam before money moves.

Regulators must also take cues from Australia and rethink consumer-protection frameworks around what behavioral intelligence now allows banks to do. By going beyond authentication and issuing guidance that requires detection of behavioral red flags, regulators can shift the industry toward proactive scam prevention — rather than relying on blunt measures like daily transfer caps or mandatory 24-hour holds that frustrate genuine customers.

APAC’s scam crisis will not slow down on its own. But with coordinated defenses, smarter detection and a shift toward understanding human behavior, the region can turn the tide.

For an in-depth look at scams in Latin America, read Josue Martinez's piece here.

For scams in the United States and Canada, read Rob Autrey's piece here.

For scams in Europe, the Middle East, and Africa, read Jonathan Frost's piece here.

To download our 2025 Global Scams report, click here.