When it comes to preventing online fraud and theft, practitioners can get hyper-focused on technical complexity, financial analysis, maintaining compliance, operational efficacy, or commercial metrics such as completion and abandonment rates and CSAT. Along the way we can easily forget that the potential victims who we’re trying to protect, our accountholders and prospective customers, are real people. As we consider our fiduciary responsibilities to protect them and their assets, it’s important to account for the most vulnerable, particularly the old and the young; those who may lack the capacity to understand the ramifications of online decisions, those whose vulnerabilities are ripe for scammers and cybercriminals.

Living in a digital, hyper-connected world may be imposing and intimidating to our senior citizens who are naturally concerned for their financial security. Meanwhile, financial naiveté is often the Achilles’ heel of younger digital natives. Critical success factors for financial criminals include understanding these vulnerabilities, how to exploit them, and circumnavigating conventional security measures.

At BioCatch, we’ve learned and demonstrated that who we are, our behaviors (the living embodiments of our individual experiences and anxieties) can serve as reliable indicators of benign or malicious online activity. Our new video series, “The Human Side of Fraud”, explores some of our vulnerabilities, anxieties, and emotions that are core to the human condition. In some cases, recognizing human weaknesses that most of us would rather not share (age, anxiety, discomfort) can serve to make us stronger and more secure.

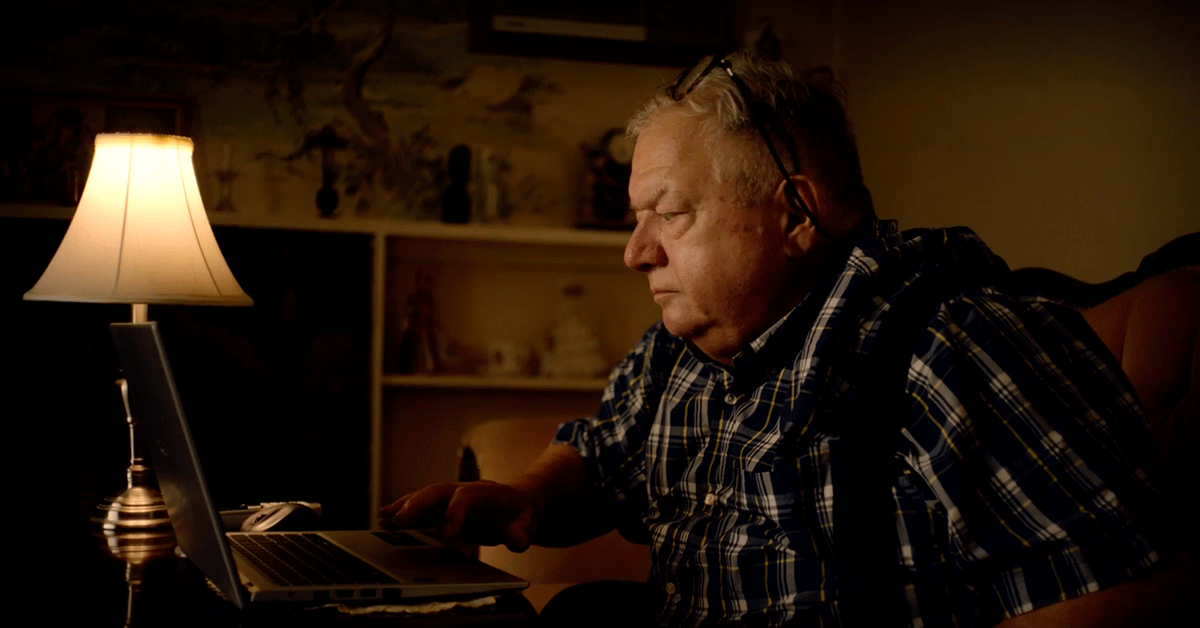

In ‘Panic’, we met a young professional woman, who comes close to falling victim to a voice scammer that threatens her with a legal inquiry. In our newest video, ‘Loneliness’, we meet an elderly gentleman who falls victim to a Remote Access Attack from a fraudster posing as a technical support agent.

More of these videos will follow, including a look at a student who finds herself acting as a money mule and a look at a criminal attempting account-opening fraud.

To learn more about how financial scammers are getting ahead including the tactics they are using to exploit the vulnerable, the limitations of existing fraud controls, and what financial institutions can do to fight back, check out BioCatch’s new E-book ‘4 Ways Financial Scammers Are Getting Ahead’.