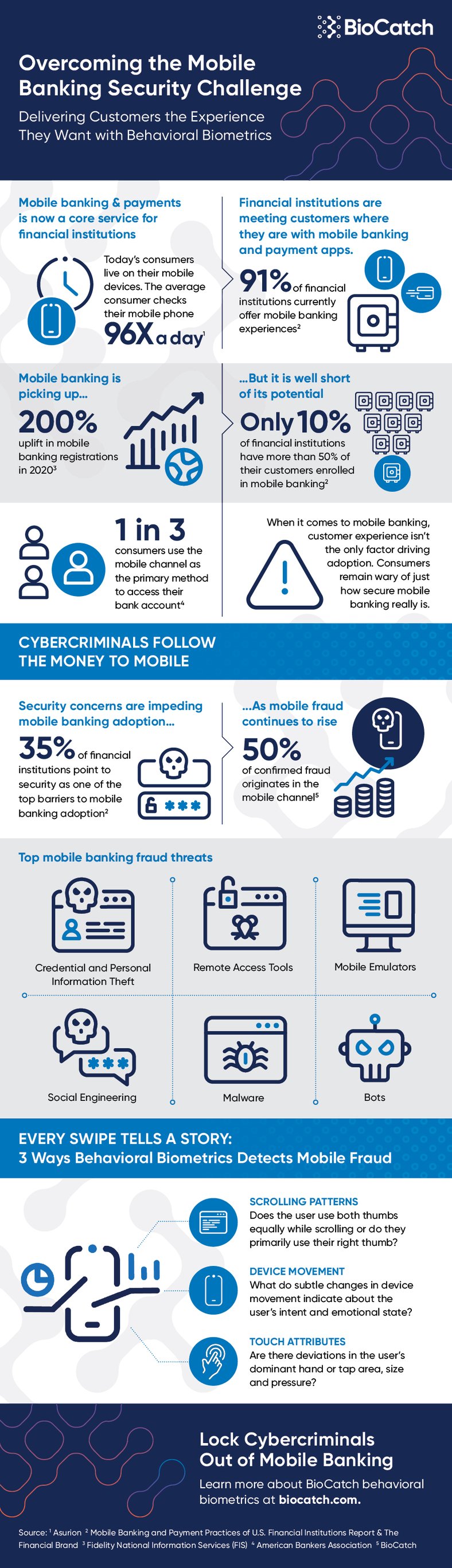

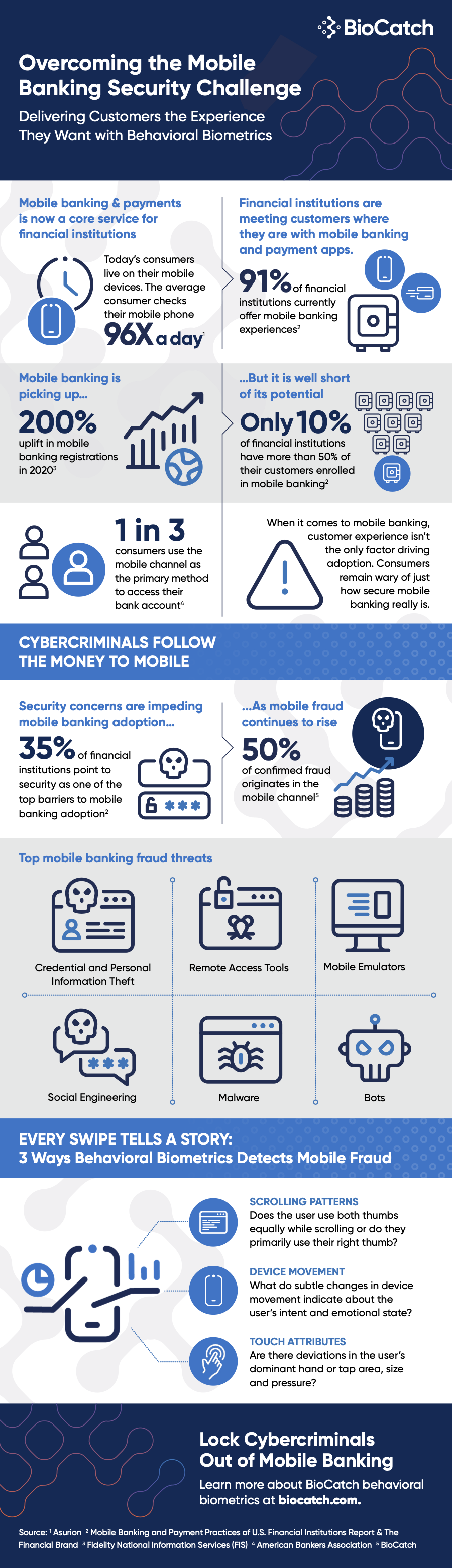

As today’s consumers live on their mobile device, it’s no surprise that there is a growing appetite for banking on the fly. With COVID-19 stay-at-home guidelines only expediting this shift, 2020 saw an extraordinary growth in new mobile banking registrations.

While the transition to mobile-first banking offers organizations a tremendous opportunity to reduce costs and capture additional revenue, cybercriminals have also followed the money to mobile, capitalizing on weaknesses in the mobile banking journey. In this fast-moving environment, where user mobility and frequent device changes has made it difficult to validate a user based solely on location, device, and network elements, financial institutions are looking for innovative ways to deliver top security without compromising the customer experience.

Behavioral biometrics delivers a fresh approach to mobile banking fraud protection by passively analyzing a user’s digital behavior to distinguish between cybercriminals and genuine users. Powered by machine learning, behavioral biometrics takes into consideration real-time mobile-specific interactions such as swipe and scrolling patterns, tap gestures, and touch events, to learn about unique user behaviors and identify subtle anomalies that can indicate high levels of risk. In mobile fraud detection, every swipe tells a story – one of a cybercriminal or one of genuine user.

This infographic explores how organizations overcome the mobile banking security challenge and deliver the seamless and secure experience consumers have come to expect.