A survey conducted by Aite-Novarica revealed that over 60% of fraud executives consider improving application fraud controls and/or policies to be the most likely rationale for increased interest in the tracking and prevention of mule accounts. Banks are motivated to be more proactive in the discipline of stopping money laundering and mules by shutting them out at the front door. This strategy can be applied to new accounts, but it does not consider existing accounts that may have already been created for this purpose.

Enter what we have called the forgotten AML gap – the time between account opening and the first transaction. In our last blog, How to Prevent Money Laundering with Behavioural Detection, Wiebe Fokma discussed the importance of detecting money launders before they transact, eliminating mule accounts, and using behavioral-based detection for transaction monitoring and account opening. As a quick recap, preventing fraud and money laundering can add up to huge savings, protect your customers, and reduce friction within a safe and reliable business. Now that we’ve taken a holistic approach to AML and behavioral detection, let’s drill down to the foundational details of a money laundering operation.

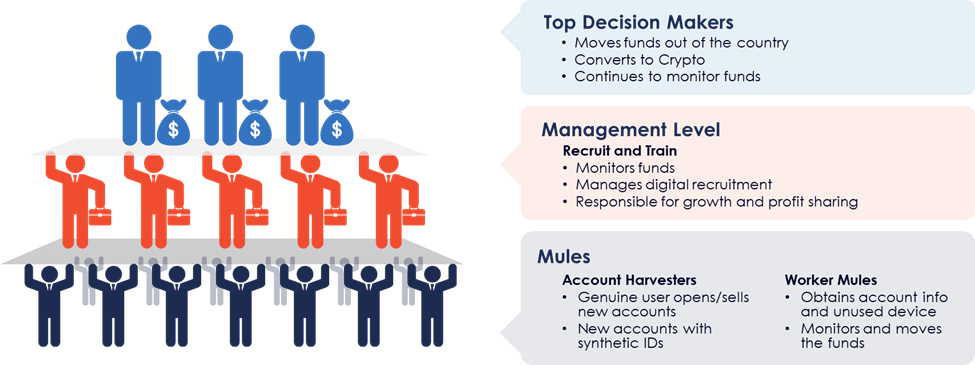

Money laundering operations get extremely complex with networks that span across many industries and geographies. When looking at these operations, they work in a way that very much resembles a classic pyramid scheme. Similar to other pyramid schemes, there is a multi-level hierarchy that separates the new members and the worst of the worst. This hierarchy consists of mules, mid-level management, and top decision-makers. These roles are described in more detail in the graphic below:

To break down the pyramid, we must first target the foundation. Account harvesters and worker mules are the cornerstone of the operation as they’re responsible for creating new accounts as well as converting active and dormant accounts. These bad actors often go unnoticed until the damage is done. That’s why detecting them before they transact is critical. Earlier detection provides an opportunity to stop the outbound transaction and decrease operational burden. By using behavioral insights to increase mule detection, the bricks begin to fall. New accounts get flagged quicker and existing accounts showing signs of risky behavior can be identified earlier.

Fraud and AML teams at many financial institutions have recognized the importance of detecting account harvesters and worker mules in the early stages. The emergence of Cyber Fusion Centers and Fraud Fusion Centers enable these formerly siloed functions to share intelligence and identify emerging trends. Technology is also playing a key role in their success.

By knocking down the foundational pillars and critical link in the supply chain infrastructure, banks can prevent serious damage to their business and customers caused by mules. To learn more about current trends in mule activity and how financial institutions are responding, download the Aite-Novarica research report, The Emerging Case for Proactive Mule Detection.