Identify application fraud and protect genuine user information from being exploited.

Identify money laundering activity and proactively detect the mule accounts before funds are moved.

Monitor web and mobile banking sessions to expose risky actions indicative of fraud.

Detect and stop authorized payment fraud before funds leave the customer’s account.

Enhance your existing compliant solution by adding security without unnecessary friction.

The world’s first inter-bank, behavior-based, financial crime intelligence-sharing network.

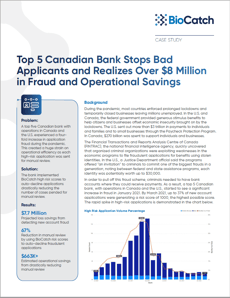

Criminals attempting to cash in on government stimulus programs during the pandemic needed accounts to receive the payments. A top five Canadian bank with operations in Canada and the U.S. experienced a fourfold increase in application fraud during this time. This created a huge strain on operational efficiency as each high-risk application had to be sent for manual review.

Criminals attempting to cash in on government stimulus programs during the pandemic needed accounts to receive the payments. A top five Canadian bank with operations in Canada and the U.S. experienced a fourfold increase in application fraud during this time. This created a huge strain on operational efficiency as each high-risk application had to be sent for manual review.

Find out how the bank implemented BioCatch high risk scores to auto-decline applications resulting in huge fraud and operational cost savings.