A world that embraces digital transformation and fast innovation offers many benefits to businesses and the everyday consumer. For example, many consumers with smart devices have drastically increased their quality of life by easily accessing critical information. Businesses now have increased flexibility, enhanced reliability and improved decision making with real-time data collection. However, this increased innovation can bring safety and data security concerns around trust, privacy, and transparency. Many fraudsters also continue to innovate while creating more elaborate and sophisticated attacks towards businesses and their customers. That’s why security, customer protection, and reducing risk have become top priorities for many businesses including banks and financial institutions.

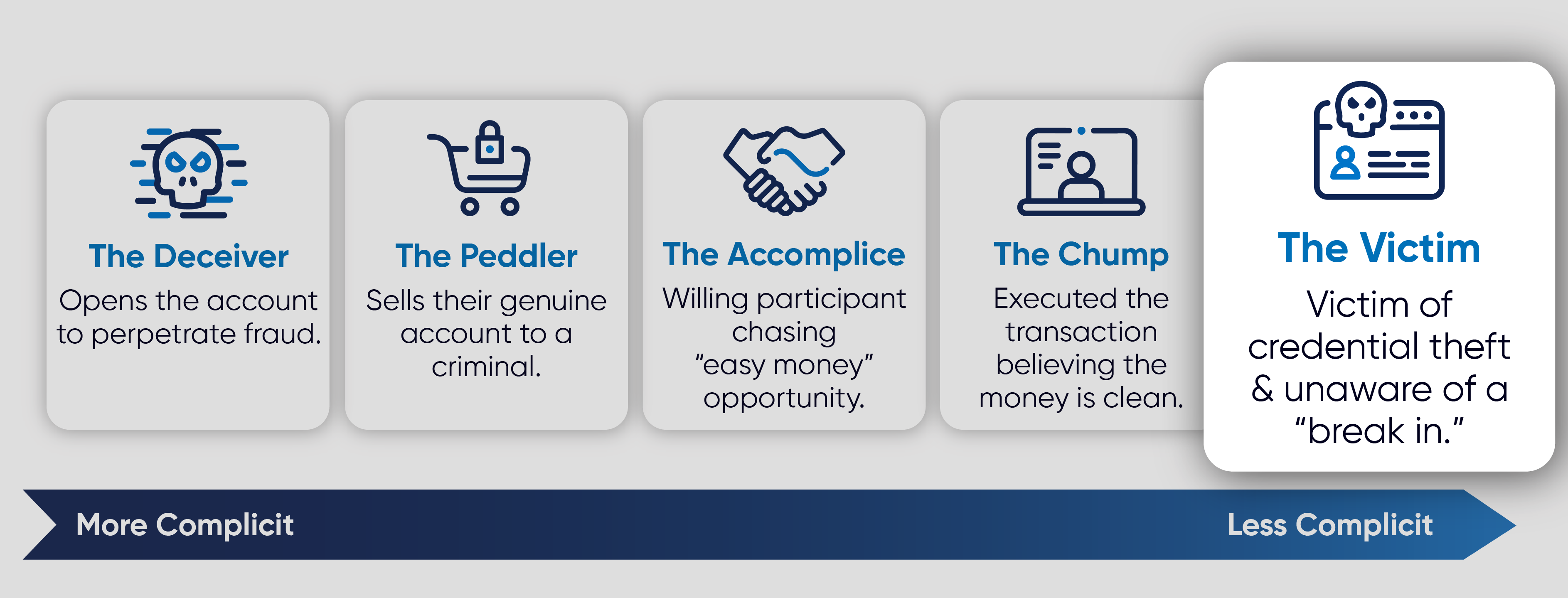

According to the Federal Trade Commission, the most common categories for consumer complaints in 2021 were identity theft and imposter scams (a subset of fraud). This leads us to examine the final persona in our mule account series, The Victim. This persona is unaware that their credentials have been stolen or compromised, whether from a data breach, phishing attack, or something else. A fraudster then takes control of a legitimate individual’s identity and account and proceeds to use it for financial gain. This is commonly referred to as account takeover.

Account takeover remains a leading cause of concern and can be extremely problematic for banks, FIs, and their customers. But not all cases of account takeover involve an unauthorized payment or transaction from the victim’s account. In the case of mules, the Victim has had their account taken over to be used for money laundering. The fraudster may deposit and send many transactions in a short amount of time before the account gets closed, frozen, or changed. This can be particularly difficult to detect and may go unnoticed by the Victim if they rarely check their account or bank statement. By the time the suspicious activity is uncovered, the money is long gone and near impossible to recover. The Victim and bank are left with an arduous investigation leading to a loss in time and potential financial penalties.

As a consumer, it is extremely important to educate yourself on identity theft protection and the best ways to keep your data and information secure. As a bank or financial institution, every new or undiscovered mule account creates multiple risks so having the right technology in place, such as behavioral biometrics, is critical to avoid operational headaches downstream.

According to a recent report by Aite-Novarica on the topic, “Among the more notable advancements in understanding and, by extension, modeling the behavioral patterns of mules comes from the behavioral biometrics company BioCatch.” BioCatch’s behavioral biometrics help financial institutions catch mules by detecting behaviors that are far more common in mules than in users who are opening legitimate accounts or accessing their own accounts for legitimate reasons.

To learn more, check out this short video on the emerging case for proactive mule detection or browse more different mule personas here.